Demystifying Medicare

According to the Fidelity Retiree Health Care Cost Estimate, an average retired couple of age 65 in 2023 may need approximately $315,000 saved (after tax) to cover health care costs in retirement. With health care costs on the rise(1), it’s never too soon to start planning how to cover these expenses during retirement. Whether you’re up for enrollment this year, five years from now, or already receiving Medicare benefits, it’s important you review and understand the nuances of Medicare offerings each year—along with the rules, restrictions and potential financial impacts to your retirement plans. Making the wrong decision can be expensive, and even making the right decision one year doesn’t mean it’s still the right decision the following year.

The basics

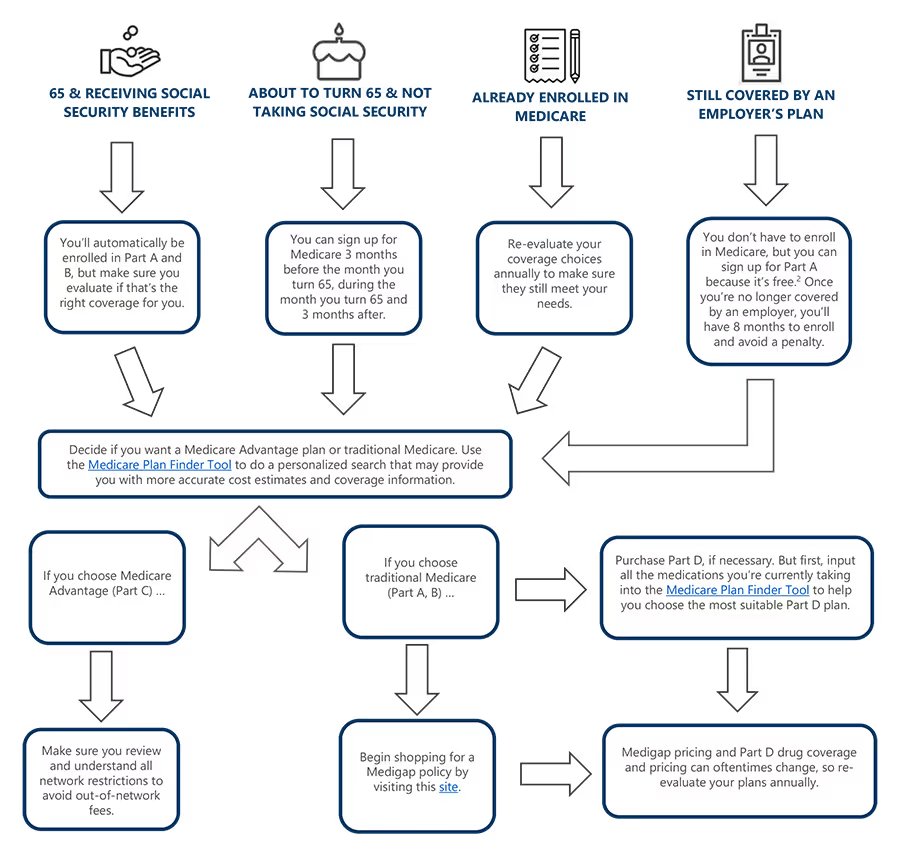

When it comes to coverage options, the first big decision to make is whether you want “traditional Medicare” or a Medicare Advantage Plan. You should apply before turning 65 to guarantee coverage, but you have 3 months after turning 65 before you incur any penalties.

Traditional Medicare – Parts A, B, and D

- Covers hospital/nursing/hospice care and costs associated with

medical supplies and services - There’s no limit for out-of-pocket costs (deductibles, copays,

coinsurance, gaps in coverage) - Medigap policies are purchased to help with additional costs and

limit total out-of-pocket expenses - If you want prescription drug coverage, you must purchase Part D

in addition to Parts A and B

Medicare Advantage – Parts C

- Covers the same benefits and services as traditional Medicare (Parts A and B), but sold by private insurance companies, usually as HMOs or PPOs

- Premiums are typically lower than traditional Medicare, but members are limited to a network of providers

- Plans typically cover extra benefits (dental or vision care, and prescription drug coverage)

- Plans have an annual limit on out-of-pocket costs

Part A

- In-patient care in hospitals

- Skilled nursing facility care

- Hospice

- Home health care

Part B

- Services/supplies needed to treat/diagnose medical conditions

- Out-patient care, durable medical equipment, lab tests,

doctor visits - Some preventive services

Part C

- Includes both Part A and B

- Run by Medicare-approved private insurance companies

- May include extra benefits and services for an additional cost

Part D

- Prescription drug coverage

- May help protect against higher costs by having deductibles and

coinsurance - Run by Medicare-approved private insurance companies

Click here for more details on Medicare options, including estimated premium costs.

5 Quick Tips to Manage a Budget

Build a realistic budget

When you’re developing a retirement budget, it’s easy to forget about health care costs since health insurance premiums are typically pulled from your paycheck before the funds hit your checking account. It’s critical to include these future monthly premiums and anticipated out of-pocket expenses into your retirement plan—and you’ll want to isolate these expenses from other retirement expenses in your financial plan, given that health care costs have been increasing two to three times the normal inflation rate.

Keep an eye on your total income

Medicare Part B and D premiums are dependent on your Modified Adjusted Gross Income (MAGI)—so, you’ll want to keep an eye on your total income for the year. For example, pulling funds from a retirement account for a large one-time distribution instead of pulling from a taxable account, Roth IRA or a home equity line can push your MAGI above certain brackets. This may double or even triple your Part B and D premiums in the coming years. A good financial advisor who has tax professionals on staff can help you manage these variables. Click here for more information on MAGI and some reduction strategies.

Mind the Medicare gap

If you choose traditional Medicare (Parts A and B), it’ll pay for most of your health care, but it doesn’t pay for everything. For example, Medicare still has many out-of-pocket costs in the form of deductibles and coinsurance. There’s also no coverage for the cost of glasses, contacts, hearing aids, routine dental work, routine footcare, routine eye exams and long-term care. These expenses can be overwhelming for people who need a lot of medications and services, so make sure you get the supplemental coverage you need. Purchasing the most suitable additional coverage plan can significantly limit your total health care expenses for the year.

Shop around for supplemental coverage

If you decide to purchase Medicare Parts A and B, “Medigap” or supplemental coverage plans can be purchased through private companies to help with additional costs and out-of-pocket expenses. By law, all supplemental coverage plans are standardized (labeled by letter) and must cover the same benefits no matter which insurance company sells them. While all Medigap plans with the same letter are identical when it comes to coverage, insurance companies can charge different prices—so, it pays to shop around every year. Prices will vary based on where you live and your age. Note: Medigap plans are not available for individuals who opt for a Medicare Advantage plan (Part C). To help decide whether a Medigap plan or Medicare Advantage plan is right for you, click here.

Look into long-term care

Majority of long-term care services are not covered by Medicare. If you’re at risk of Alzheimer’s, dementia, or if you don’t have family to care for you in the event that you can no longer perform daily activities, you may want to look into a long-term care insurance policy to protect you from spending down all of your retirement assets on a long-term care facility. These policies vary greatly and can be very expensive—so it’s important you compare policies from multiple providers to guarantee the best price. If you purchase a policy, don’t forget to include the premiums in your retirement budget—as well as room for those premiums to potentially rise.

Where do I go from here?

Work with professionals who have

your best interest in mind

If you choose to work with a financial advisor to navigate through your Medicare enrollment, be certain it’s someone who is competent in the rules of Medicare and knows the nuances of the all the available supplemental and Medicare Advantage plans.

If you end up working with an insurance specialist or agent,* make sure they only charge a fee or an hourly rate—not a commission. Commission-based agents may be incentivized to suggest plans that are more lucrative for their business, and not the right fit for your financial situation or retirement goals.

Be cautious of advisors who

- Only sells offerings from one or two insurance companies

- Works on commission

- Pushes you into the most expensive Medicare option without

assessing your unique needs

According to the Fidelity Retiree Health Care Cost Estimate, an average retired couple of age 65 in 2023 may need approximately $315,000 saved (after tax) to cover health care costs in retirement. With health care costs on the rise(1), it’s never too soon to start planning how to cover these expenses during retirement. Whether you’re up for enrollment this year, five years from now, or already receiving Medicare benefits, it’s important you review and understand the nuances of Medicare offerings each year—along with the rules, restrictions and potential financial impacts to your retirement plans. Making the wrong decision can be expensive, and even making the right decision one year doesn’t mean it’s still the right decision the following year.

The basics

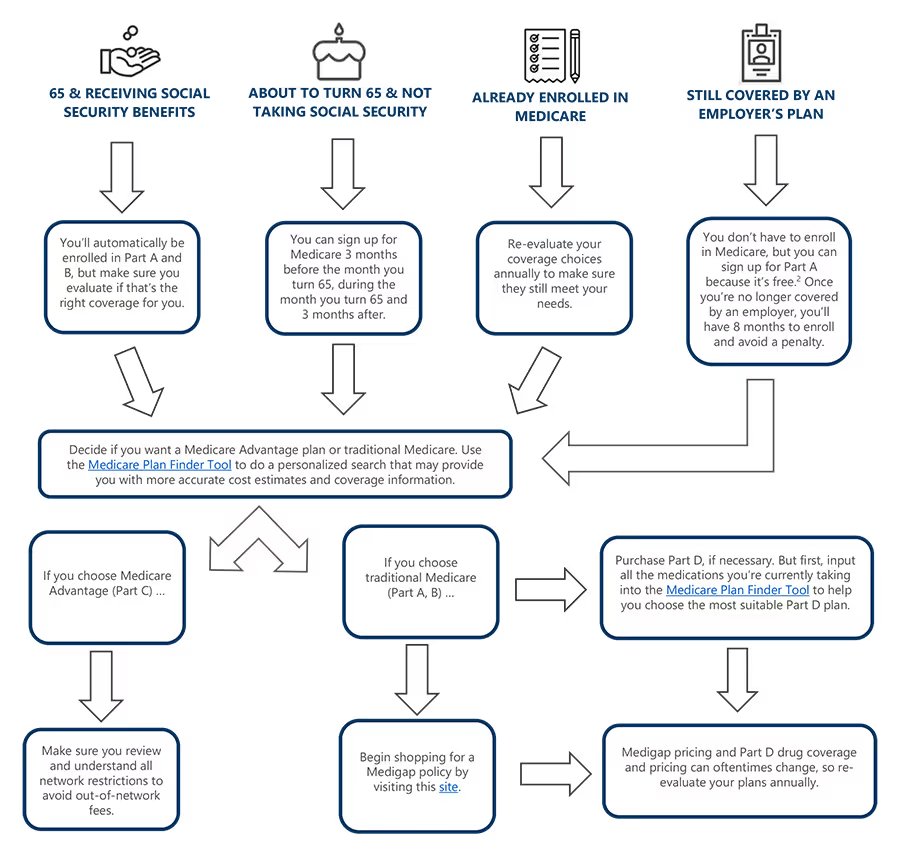

When it comes to coverage options, the first big decision to make is whether you want “traditional Medicare” or a Medicare Advantage Plan. You should apply before turning 65 to guarantee coverage, but you have 3 months after turning 65 before you incur any penalties.

Traditional Medicare – Parts A, B, and D

- Covers hospital/nursing/hospice care and costs associated with

medical supplies and services - There’s no limit for out-of-pocket costs (deductibles, copays,

coinsurance, gaps in coverage) - Medigap policies are purchased to help with additional costs and

limit total out-of-pocket expenses - If you want prescription drug coverage, you must purchase Part D

in addition to Parts A and B

Medicare Advantage – Parts C

- Covers the same benefits and services as traditional Medicare (Parts A and B), but sold by private insurance companies, usually as HMOs or PPOs

- Premiums are typically lower than traditional Medicare, but members are limited to a network of providers

- Plans typically cover extra benefits (dental or vision care, and prescription drug coverage)

- Plans have an annual limit on out-of-pocket costs

Part A

- In-patient care in hospitals

- Skilled nursing facility care

- Hospice

- Home health care

Part B

- Services/supplies needed to treat/diagnose medical conditions

- Out-patient care, durable medical equipment, lab tests,

doctor visits - Some preventive services

Part C

- Includes both Part A and B

- Run by Medicare-approved private insurance companies

- May include extra benefits and services for an additional cost

Part D

- Prescription drug coverage

- May help protect against higher costs by having deductibles and

coinsurance - Run by Medicare-approved private insurance companies

Click here for more details on Medicare options, including estimated premium costs.

5 Quick Tips to Manage a Budget

Build a realistic budget

When you’re developing a retirement budget, it’s easy to forget about health care costs since health insurance premiums are typically pulled from your paycheck before the funds hit your checking account. It’s critical to include these future monthly premiums and anticipated out of-pocket expenses into your retirement plan—and you’ll want to isolate these expenses from other retirement expenses in your financial plan, given that health care costs have been increasing two to three times the normal inflation rate.

Keep an eye on your total income

Medicare Part B and D premiums are dependent on your Modified Adjusted Gross Income (MAGI)—so, you’ll want to keep an eye on your total income for the year. For example, pulling funds from a retirement account for a large one-time distribution instead of pulling from a taxable account, Roth IRA or a home equity line can push your MAGI above certain brackets. This may double or even triple your Part B and D premiums in the coming years. A good financial advisor who has tax professionals on staff can help you manage these variables. Click here for more information on MAGI and some reduction strategies.

Mind the Medicare gap

If you choose traditional Medicare (Parts A and B), it’ll pay for most of your health care, but it doesn’t pay for everything. For example, Medicare still has many out-of-pocket costs in the form of deductibles and coinsurance. There’s also no coverage for the cost of glasses, contacts, hearing aids, routine dental work, routine footcare, routine eye exams and long-term care. These expenses can be overwhelming for people who need a lot of medications and services, so make sure you get the supplemental coverage you need. Purchasing the most suitable additional coverage plan can significantly limit your total health care expenses for the year.

Shop around for supplemental coverage

If you decide to purchase Medicare Parts A and B, “Medigap” or supplemental coverage plans can be purchased through private companies to help with additional costs and out-of-pocket expenses. By law, all supplemental coverage plans are standardized (labeled by letter) and must cover the same benefits no matter which insurance company sells them. While all Medigap plans with the same letter are identical when it comes to coverage, insurance companies can charge different prices—so, it pays to shop around every year. Prices will vary based on where you live and your age. Note: Medigap plans are not available for individuals who opt for a Medicare Advantage plan (Part C). To help decide whether a Medigap plan or Medicare Advantage plan is right for you, click here.

Look into long-term care

Majority of long-term care services are not covered by Medicare. If you’re at risk of Alzheimer’s, dementia, or if you don’t have family to care for you in the event that you can no longer perform daily activities, you may want to look into a long-term care insurance policy to protect you from spending down all of your retirement assets on a long-term care facility. These policies vary greatly and can be very expensive—so it’s important you compare policies from multiple providers to guarantee the best price. If you purchase a policy, don’t forget to include the premiums in your retirement budget—as well as room for those premiums to potentially rise.

Where do I go from here?

Work with professionals who have

your best interest in mind

If you choose to work with a financial advisor to navigate through your Medicare enrollment, be certain it’s someone who is competent in the rules of Medicare and knows the nuances of the all the available supplemental and Medicare Advantage plans.

If you end up working with an insurance specialist or agent,* make sure they only charge a fee or an hourly rate—not a commission. Commission-based agents may be incentivized to suggest plans that are more lucrative for their business, and not the right fit for your financial situation or retirement goals.

Be cautious of advisors who

- Only sells offerings from one or two insurance companies

- Works on commission

- Pushes you into the most expensive Medicare option without

assessing your unique needs

.avif)